For shippers managing multiple lanes the choice between contract and spot freight has a direct impact on cost and service. Understanding how to build lane stability helps logistics managers move from reactive to strategic mode. This guide explains the key differences, when to use each, and how a transparent freight broker supports long-term stability.

What “lane stability” means for shippers

Defining lane stability (volume, service, cost)

Lane stability refers to the consistent movement of freight on specific origin-destination pairs with predictable cost, reliable service and the capacity to plan ahead. For example a manufacturer shipping 300 dry-van loads per month from the West Coast to the Midwest needs regular pickups, known transit times and stable rates.

Why instability hurts costs and service (examples: seasonal peaks, driver shortages)

When lanes operate on the spot market only, service can suffer if carrier capacity tightens or rates spike. Consider a peak season when reefer loads double but no contract capacity covers the increase—the shipper may pay excessively for spot freight or face missed pickups. That translates into higher costs and lower on-time delivery.

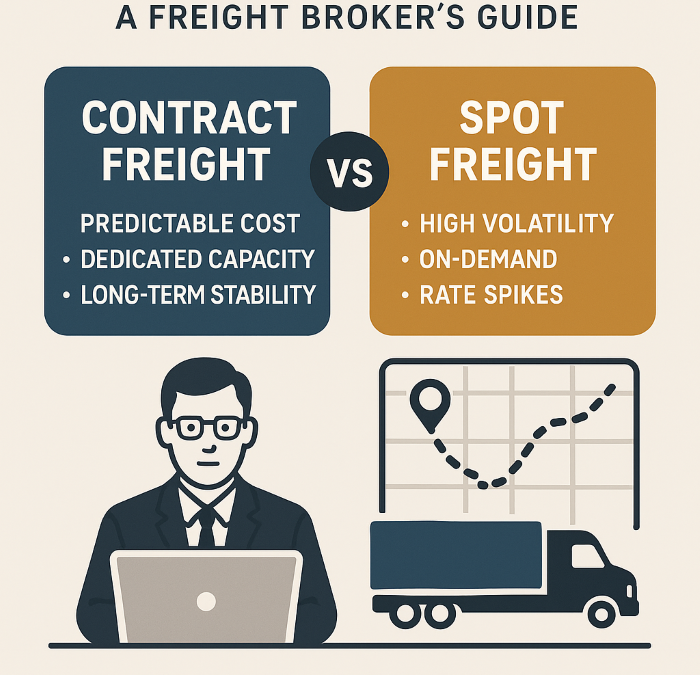

Contract freight vs spot freight – key differences

What is a contract rate (volume commitment, term, fixed margin)

A contract rate is a negotiated price covering a set volume of freight over a defined period of time. It allows the carrier or broker to plan capacity and equipment in advance. According to industry guidance the contract market often makes up about 80 % of truckload moves.

What is a spot rate (on-demand, market-driven, high volatility)

A spot rate applies to a single load or ad-hoc shipment, quoted based on real-time supply and demand. These rates can shift daily or even hourly, depending on capacity constraints or fuel cost swings.

How the contract-vs-spot spread behaves (leading indicator, market cycles)

Industry data show the spread between spot and contract rates serves as a market indicator. When spot rates rise significantly above contract rates, it often signals capacity tightening and triggers contract renegotiations. For example when spot rates exceed contract by more than 10 % the contract market tends to adjust.

How lane stability is impacted by contract vs spot choices

Contract lanes and their stability benefits (predictable cost, dedicated capacity)

By locking in contract lanes for high-volume, consistent shipments a shipper gains cost predictability, better forecasting and often priority service. For example a food-manufacturer using dedicated reefer equipment under contract avoids the spot surge in harvest season.

Risks when relying on spot-market lanes (capacity risk, rate spikes, service failures)

If a lane is managed purely on the spot market, the shipper is exposed to sudden rate hikes, limited capacity or carrier drop-outs. For instance a construction-materials shipper who chooses spot lanes during a surge may end up paying 30 % more and still experience missed deliveries.

Real-world lane scenario: manufacturing steady lanes vs ad-hoc seasonal lanes

A consumer-goods manufacturer shipping daily FTL loads from Houston to Toronto establishes a contract lane to lock cost and service. Meanwhile the same shipper uses spot freight for a seasonal spike into Florida. This hybrid approach balances stability and flexibility.

The smart hybrid strategy for stability and flexibility

Core contract lanes + overflow spot usage

A pragmatic strategy is to identify your core lanes (high volume, stable origin-destination, service critical) and assign them to contract. Use spot freight for overflow, new lanes, seasonal peaks or one-off loads. This mirrors the strategic freight-mix approach advocated by carriers and brokers.

How to evaluate lanes (volume consistency, service criticality, equipment type: FTL, LTL, reefer, flatbed)

Ask key questions: Is the shipment recurring and predictable? What equipment type is required? Is timely delivery mission-critical? For instance if you have 100 flatbed loads per month on a fixed route you likely migrate to a contract lane.

Example: drop trailer program + asset-based carriers to lock stability

A drop-trailer program supports contract lanes by positioning trailers at shipper sites, reducing detention and enabling carriers to plan back-hauls. Combined with vetted asset-based carriers this drives stability.

What to look for in a freight broker for lane stability

Transparent freight brokerage features: low fixed margin, full carrier name & rate disclosure

When selecting a broker prioritise transparency. At 1fr8.broker we disclose carrier names and rates so shippers have full visibility. “Low fixed margin removes the incentive to play the spread.” This openness aligns incentives for service and cost.

Vetted asset fleets, no back-solicitation clauses, dedicated lanes support

Ensure the broker works with vetted asset carriers, gives you access to performance scorecards, and has clear policies against back-solicitation. That protects lane stability and capacity continuity.

Tools for scorecards, accessorial transparency, route-guide oversight

Stable lanes require ongoing measurement. Scorecards track On-Time Delivery (OTD), detention, claims ratio, and accessorial fees. A good broker ensures accessorials aren’t hidden and the route guide is enforced.

Why 1fr8.broker’s model supports lane stability

Our low fixed margin model explained

Unlike traditional brokers who play the spread, we adopt a low fixed margin model. This means cost transparency and fewer surprises in contract lanes.

Carrier name & rate disclosure – how that promotes service and accountability

By disclosing actual carrier names and agreed rates we enable shippers to hold carriers accountable. This tends to elevate service levels, reduce claims and support stable lanes.

Case example: typical shipper lane transition from spot to contract with us

One manufacturing client shipping 400 dry-van loads per month moved from spot to contract using our vetted fleet. They achieved a 98 % OTD on the new contract lane and reduced rate volatility by 15 %. (Hypothetical example)

[Link to Case Studies]

Practical takeaways for shippers

Five actions to stabilise your lane portfolio

- Map your lanes and classify by volume, consistency, service criticality.

- Choose contract for lanes with predictable volume and service expectations.

- Use spot freight strategically for overflow, seasonal peaks or new lanes.

- Partner with a broker that offers full transparency: carrier name, rate, scorecards.

- Review your lane performance quarterly: OTD, accessorials, margin, carrier compliance.

Checklist for your next RFP: contract vs spot questions to ask

- What volume commitment is required?

- What is the term of the contract?

- How are rate adjustments handled (fuel, accessorials, regulatory cost)?

- Can I see the carrier name and rate you plan to use?

- What are your service guarantee metrics (OTD, detention, claims)?

- How do you manage overflow spot freight if primary carrier capacity fails?

How to begin the conversation with 1fr8.broker

If you are ready to build stable lanes with transparent cost and service, visit [Request a Quote] to start with 1fr8.broker.

Frequently Asked Questions

When should I use spot vs contract for a new lane?

If your lane has irregular volume or you are testing origin-destination pairs, start in the spot market. Once volume and service patterns stabilise, transition to contract for cost predictability.

Can we shift a lane from spot to contract mid-year?

Yes. Use a proven spot track record to build volume history, then issue a contract RFP to secure dedicated capacity and stable pricing.

What happens if carrier cost spikes (fuel, regulation) under contract?

A well-designed contract includes escalation or adjustment clauses (fuel surcharge, regulatory pass-through) and regular review. Transparent brokers will show you these elements and monitor performance.

Conclusion

Choosing between contract and spot freight is not a binary decision for shippers seeking lane stability. It is a strategic mix. Contract lanes give predictable cost and service. Spot lanes offer flexibility and overflow capacity. The key lies in segmenting your lanes, deploying each freight model where it fits, and partnering with a broker that rewards transparency, vetted asset fleets and full visibility into carrier name, rates and performance.

Contact Us Today

Ready to simplify your shipping experience? Contact One Freight Broker to discover how our expertise can benefit your business, ensuring your cargo is in safe hands every step of the way.

For more information on how we can assist your business, visit our website at 1fr8.broker.